HSBC UK has partnered with Shelter, a leading homelessness charity, to raise awareness about the importance of financial resilience in avoiding homelessness. Through their partnership, they aim to provide crucial support and guidance to individuals facing the risk of losing their homes amidst the ongoing cost-of-living crisis. With a powerful out-of-home activation at London’s King’s Cross Station, they seek to emphasize the significance of solid financial support in building resilience and breaking the vicious circle of homelessness.

HSBC and Shelter: A Multi-Year Partnership

HSBC and Shelter have joined hands in a long-term commitment to assist over a million people who are at risk of homelessness. Recognizing the pressing need for support, they have already helped thousands of individuals experiencing homelessness gain access to essential banking services and rebuild their lives. However, the magnitude of the cost-of-living crisis demands a heightened level of assistance and outreach.

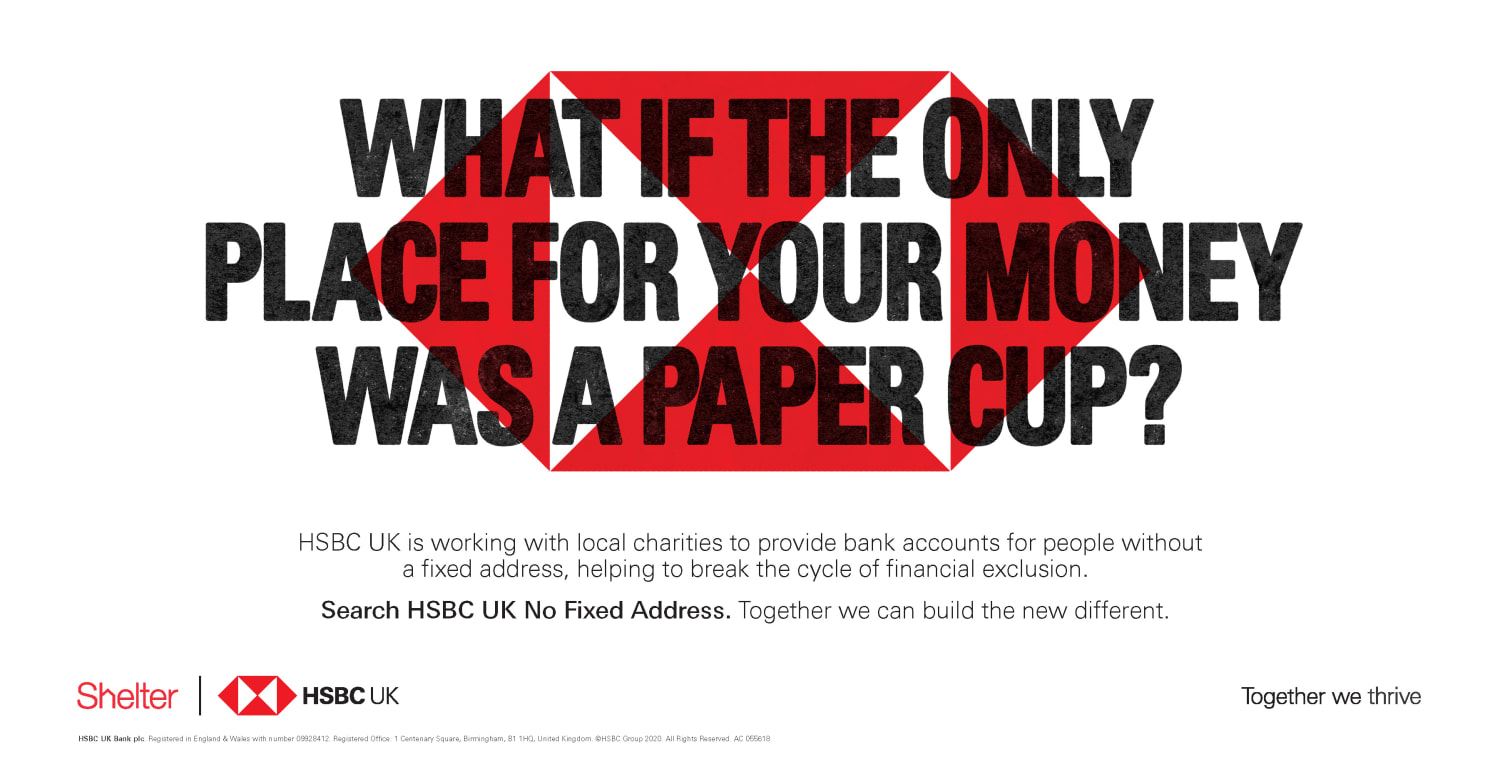

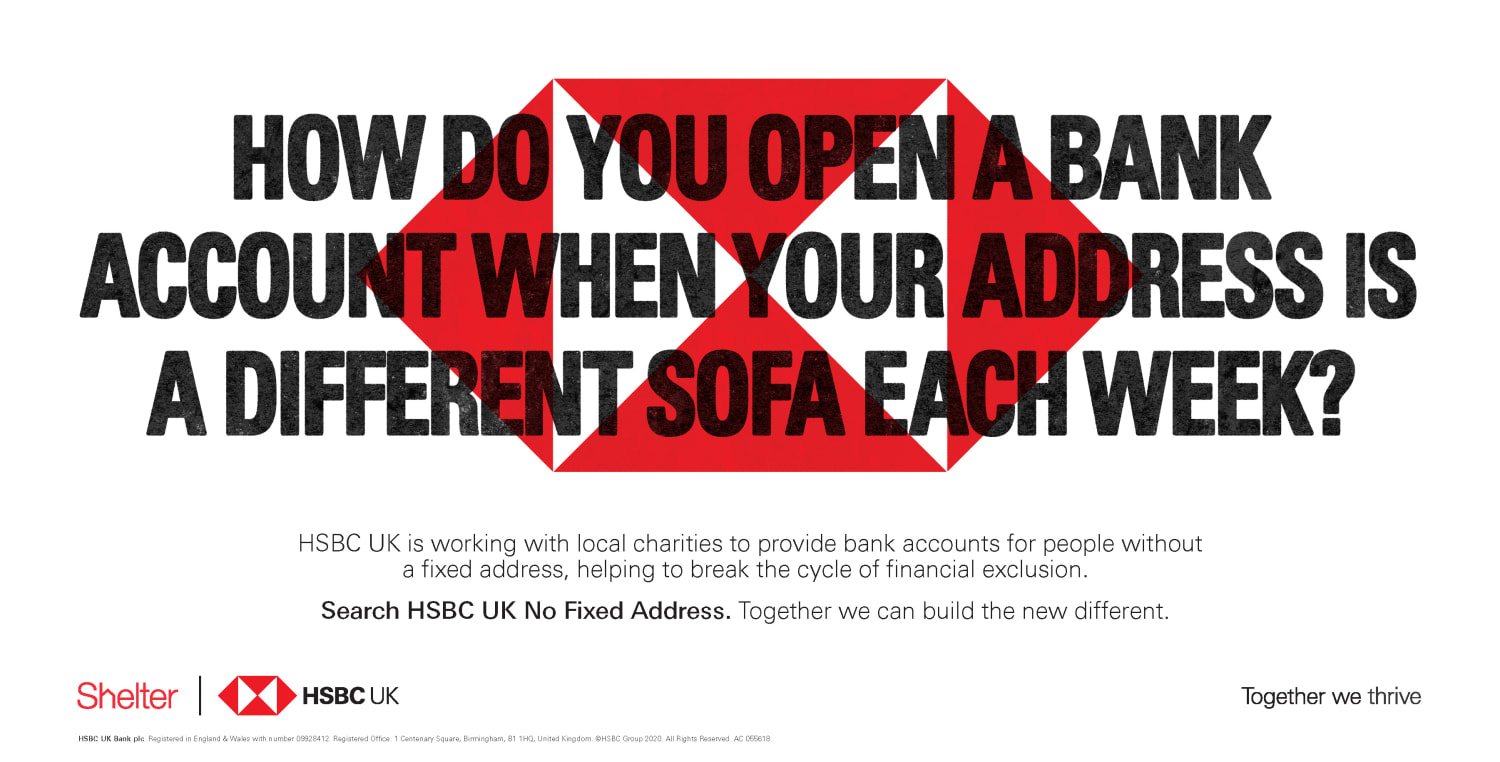

The Campaign

As part of the campaign, created in collaboration with creative agency Wunderman Thompson, The Homeless Bank Accounts are promoted in five UK cities with high rates of homelessness through digital out-of-home and out-of-home advertisements. In locations where the homeless frequently seek refuge, such as bus shelters and railway stations, advertisements with messages started to appear. Some of these advertisements featured QR codes that could be scanned to donate to Shelter.

How Financial Support Can Prevent Homelessness?

The campaign aims to show how providing solid financial support and guidance can help build resilience and prevent people from becoming homeless in the first place. HSBC UK and Shelter have pledged to help over 1 million at-risk individuals access resources to strengthen their financial security.

Sarah Mayall, head of brand marketing at HSBC UK, explained, “Through our new partnership, and activations such as this, we hope to reach out to even more people to help them understand the importance of financial resilience and avoid the vicious circle of homelessness before they get to that point.”

Reconnecting the Homeless through Innovative Solutions

In a way for addressing the challenges faced by homeless individuals in opening bank accounts, HSBC UK has taken a pioneering step to help them reconnect with society. Traditionally, banks require photo identification and proof of address, which many homeless people may lack. However, at select HSBC UK branches, individuals without a fixed address can now open a bank account using a participating charity’s address as their proof of identity. This innovative solution, accompanied by a charity caseworker, provides a crucial lifeline and breaks down barriers to financial inclusion.

Boosting Resources to Help Those in Need

HSBC UK and Shelter will work together to increase the capacity of Shelter’s emergency helpline and webchat services. They will also build new digital tools and guidance to help people improve their financial resilience. The campaign comes at a time when many face losing their homes due to the rising cost of living in the UK.

Mike Watson, creative director at Wunderman Thompson UK, said, “When people fall on hard times, they often hope it’s a temporary circumstance, but in reality, without help, it can be hard for them to get back on their feet. This activation brings to life the vicious circle of financial exclusion and shows what Shelter and HSBC UK are doing to help break it.”

By providing vital resources and support for those at risk of homelessness, HSBC UK and Shelter are working to break the cycle of hardship and build a more stable future for all. The campaign is thus an important step in raising awareness about this critical issue.

Final Take

HSBC and Shelter’s partnership is an important step in preventing homelessness by helping people develop financial resilience. Wunderman Thompson’s creativity needs to appreciated foremost in this aspect. Placing an activation at King’s Cross Station helps to get good reach for the campaign. It will raise awareness of the issue and encourage people to seek support before it becomes a crisis. Through the partnership’s digital guidance and tools, people at risk of losing their homes can develop the financial resilience they need to avoid the vicious circle of financial exclusion and prevent homelessness. Needless to say, the campaign is a great initiative that benefits both the society and brands as well.