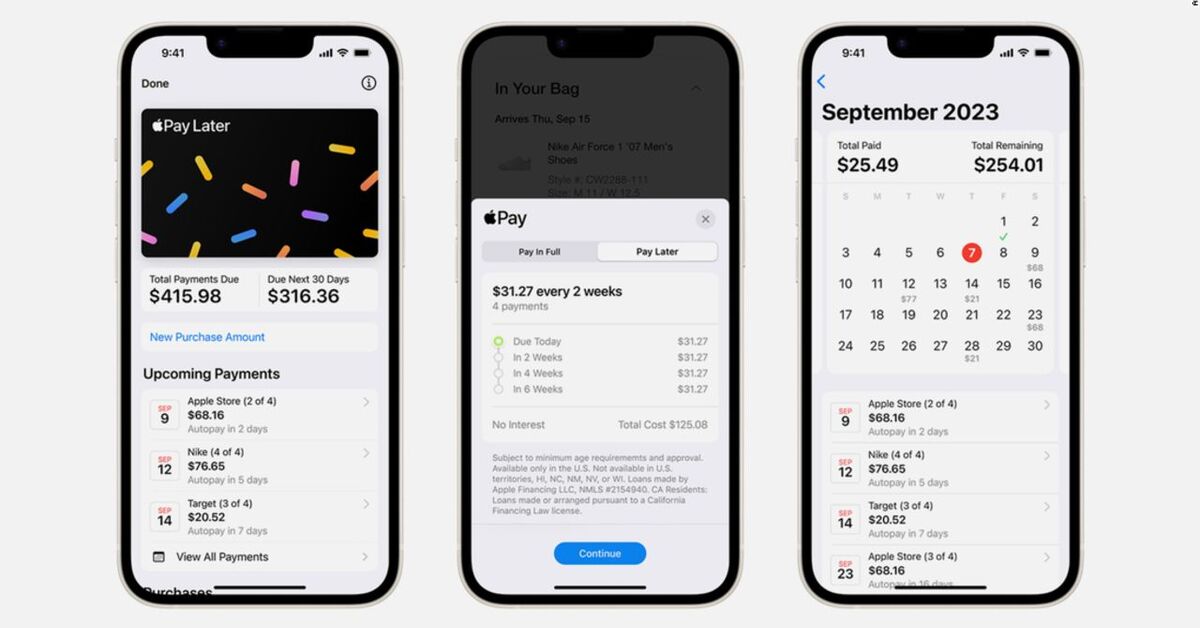

Apple has recently announced its latest feature, Apple Pay Later, which is designed to allow customers to pay for online purchases in installments. With this new feature, Apple users can split payments into four installments over six weeks, with the first installment due at the point of purchase. Additionally, Apple users can also apply for a loan ranging from $50 to $1000 with no interest or fees to make online or in-app purchases. Let’s take a stroll through all those facilities that Apple’s latest technology provides to their users which ensure Apple Pay Later a strong position for Apple’s brand as a global leader in innovation and user experience.

Flexible Payment Options for All

According to Jennifer Bailey, Apple’s Vice President of Apple Pay and Apple Wallet, the new feature is “designed with users’ financial health in mind.” With no one-size-fits-all approach when it comes to how people manage their finances, many people are looking for flexible payment options, which is why Apple is excited to provide its users with Apple Pay Later.

Track and Manage Loan Payments with Ease

Through the Wallet app, Apple users can track and manage upcoming loan payments. Any loan application can also be done in the app with no impact on credit. This feature will make it easier for users to keep track of their finances and manage their payments with ease.

Enabled Through the Mastercard Installments Program

Apple’s Pay Later option is enabled through the Mastercard Installments program. This program is designed to help customers make purchases without having to pay the full amount upfront. With this program, customers can pay for their purchases in installments, making it easier to manage their finances.

The Rise of Buy Now, Pay Later Trend

The pandemic-related lockdowns in 2020 have turned shoppers to online payment platforms, bolstering demand for fintech companies offering BNPL (buy now, pay later) services, especially to millennials and Gen Z customers. Digital payments behemoths including PayPal Holdings Inc and Block Inc have expanded into the sector through acquisitions, while Affirm went public in a multi-billion dollar listing.

Despite the sector’s fortunes turning amid rising interest rates and red hot inflation, Apple’s new feature will provide users with a flexible payment option that will help them manage their finances more effectively.

The Go-To Payment Option for Apple Users

With the introduction of Apple Pay Later, Apple has taken a significant step towards strengthening its branding as a company that prioritizes accessibility and convenience for its users. This latest payment option is poised to become the go-to choice for Apple users who seek a flexible and user-friendly way to manage their finances while making online purchases.